A health insurance premium subsidy is financial assistance to help individuals pay for their health insurance premiums. It reduces the cost of monthly payments.

Health insurance premium subsidies make healthcare more affordable for low-income individuals and families. They are typically provided through government programs like the Affordable Care Act (ACA) in the United States. These subsidies can significantly lower the amount you pay for your health insurance each month.

Eligibility often depends on your income level and household size. By reducing the financial burden, subsidies ensure that more people have access to necessary medical care. Understanding how these subsidies work can help you make better decisions about your healthcare coverage and manage your expenses effectively.

Introduction To Health Insurance Subsidies

Health insurance can be expensive. Many people need help to afford it. This is where health insurance subsidies come in. Subsidies help lower the cost of health insurance premiums. They make health insurance more affordable for everyone.

Basics Of Premium Subsidies

Premium subsidies are financial aids. They help reduce the cost of your health insurance premiums. These subsidies are often based on your income and family size.

Here are some key points about premium subsidies:

- Income-based: Your subsidy depends on how much money you earn.

- Family size: The number of people in your family affects your subsidy amount.

- Marketplace Plans: Subsidies are available for plans on the health insurance marketplace.

Importance Of Subsidies

Subsidies are very important. They help millions of people afford health insurance. Without subsidies, many people would not be able to pay for their insurance premiums.

Here’s why subsidies are crucial:

- Access to Healthcare: Subsidies make health insurance affordable. This gives more people access to healthcare services.

- Financial Relief: They reduce the financial burden on families. This allows them to save money for other needs.

- Public Health Improvement: More people with insurance means better public health. Everyone benefits when more people can see doctors and get treatments.

In conclusion, health insurance subsidies play a vital role. They make healthcare affordable and accessible to more people. Understanding how they work can help you make better health insurance choices.

Credit: www.kff.org

Eligibility Criteria

Understanding the Eligibility Criteria for a health insurance premium subsidy is crucial. This helps you know if you can receive financial assistance. Let’s break it down into two main parts: Income Requirements and Other Qualifying Factors.

Income Requirements

To qualify for a health insurance premium subsidy, your income must fall within a certain range. This range is based on the Federal Poverty Level (FPL). The FPL is a measure used to decide who gets aid.

- If your income is between 100% and 400% of the FPL, you may qualify.

- For a single person, this is about $12,880 to $51,520 per year.

- For a family of four, it is about $26,500 to $106,000 per year.

The table below shows the income levels for different family sizes:

| Family Size | 100% FPL | 400% FPL |

|---|---|---|

| 1 | $12,880 | $51,520 |

| 2 | $17,420 | $69,680 |

| 3 | $21,960 | $87,840 |

| 4 | $26,500 | $106,000 |

Other Qualifying Factors

Besides income, there are other factors that can affect your eligibility. These include:

- Your citizenship status must be valid.

- You cannot be eligible for Medicare or Medicaid.

- You must file a tax return for the year you seek the subsidy.

Additionally, if your employer offers affordable coverage, you may not qualify for the subsidy. Affordable coverage means the employee’s share of the premium is less than 9.83% of their household income.

Understanding these factors can help you determine if you qualify for a health insurance premium subsidy. Make sure you meet both the income requirements and other qualifying criteria.

Types Of Subsidies

Health insurance premium subsidies help make healthcare more affordable. There are different types of subsidies to assist eligible individuals. Two main types are Advanced Premium Tax Credits and Cost-Sharing Reductions. Each type offers unique benefits.

Advanced Premium Tax Credits

Advanced Premium Tax Credits (APTC) reduce your monthly health insurance payments. These credits are based on your income and family size. You can choose to apply them throughout the year. This makes your monthly premiums lower.

Eligibility for APTC depends on your household income. Typically, households earning between 100% and 400% of the federal poverty level qualify. You must also buy your plan through the Health Insurance Marketplace.

Cost-sharing Reductions

Cost-Sharing Reductions (CSR) lower out-of-pocket costs for healthcare services. These include deductibles, copayments, and coinsurance. CSRs are available to those with income between 100% and 250% of the federal poverty level.

To get CSRs, you must enroll in a Silver plan through the Health Insurance Marketplace. This requirement ensures you get the best value from your subsidy. CSRs help make healthcare expenses more manageable for lower-income families.

| Type of Subsidy | Benefit | Eligibility | Plan Requirement |

|---|---|---|---|

| Advanced Premium Tax Credits | Lower monthly premiums | 100%-400% FPL | Marketplace plans |

| Cost-Sharing Reductions | Lower out-of-pocket costs | 100%-250% FPL | Silver plans only |

Credit: www.healthinsurance.org

Application Process

The application process for a health insurance premium subsidy is straightforward. This guide will help you through each step. Ensure you follow each section carefully.

Where To Apply

You can apply for a health insurance premium subsidy through several platforms. Each platform has its own process. Below are the most common places to apply:

- Government Health Insurance Marketplaces: These are state or federal websites. They provide a centralized place to apply for subsidies and insurance plans.

- Healthcare.gov: This is the federal marketplace. It is used by many states.

- State-Specific Marketplaces: Some states have their own marketplaces. Examples include Covered California or New York State of Health.

Required Documentation

Before you start your application, gather all necessary documents. This will make the process smoother. Here are the key documents you will need:

| Document | Purpose |

|---|---|

| Proof of Income | Verify your household income. This can include pay stubs, tax returns, or benefit letters. |

| Social Security Numbers | Needed for each household member applying for coverage. |

| Immigration Documents | Required if you are not a U.S. citizen. |

| Employer Information | Details about your job and insurance offered by your employer. |

Having these documents ready will speed up the application process. Make sure all documents are current and accurate.

Impact On Monthly Premiums

Understanding the impact of a health insurance premium subsidy on your monthly premiums can save you money. Subsidies help reduce the amount you pay each month.

Reduction In Costs

A premium subsidy directly lowers your health insurance costs. This means you pay less each month for your insurance plan.

Subsidies are based on your income level and family size. They help make health insurance more affordable for many people.

- Lower-income families receive higher subsidies.

- Middle-income families also benefit from reduced premiums.

Examples Of Savings

Consider a family of four with an annual income of $50,000. Without a subsidy, their monthly premium might be $1,200. With a subsidy, it could drop to $400.

| Income Level | Monthly Premium (Before Subsidy) | Monthly Premium (After Subsidy) |

|---|---|---|

| $25,000 | $800 | $100 |

| $50,000 | $1,200 | $400 |

| $75,000 | $1,500 | $900 |

These examples show significant savings for families. The lower monthly premiums make health insurance more accessible.

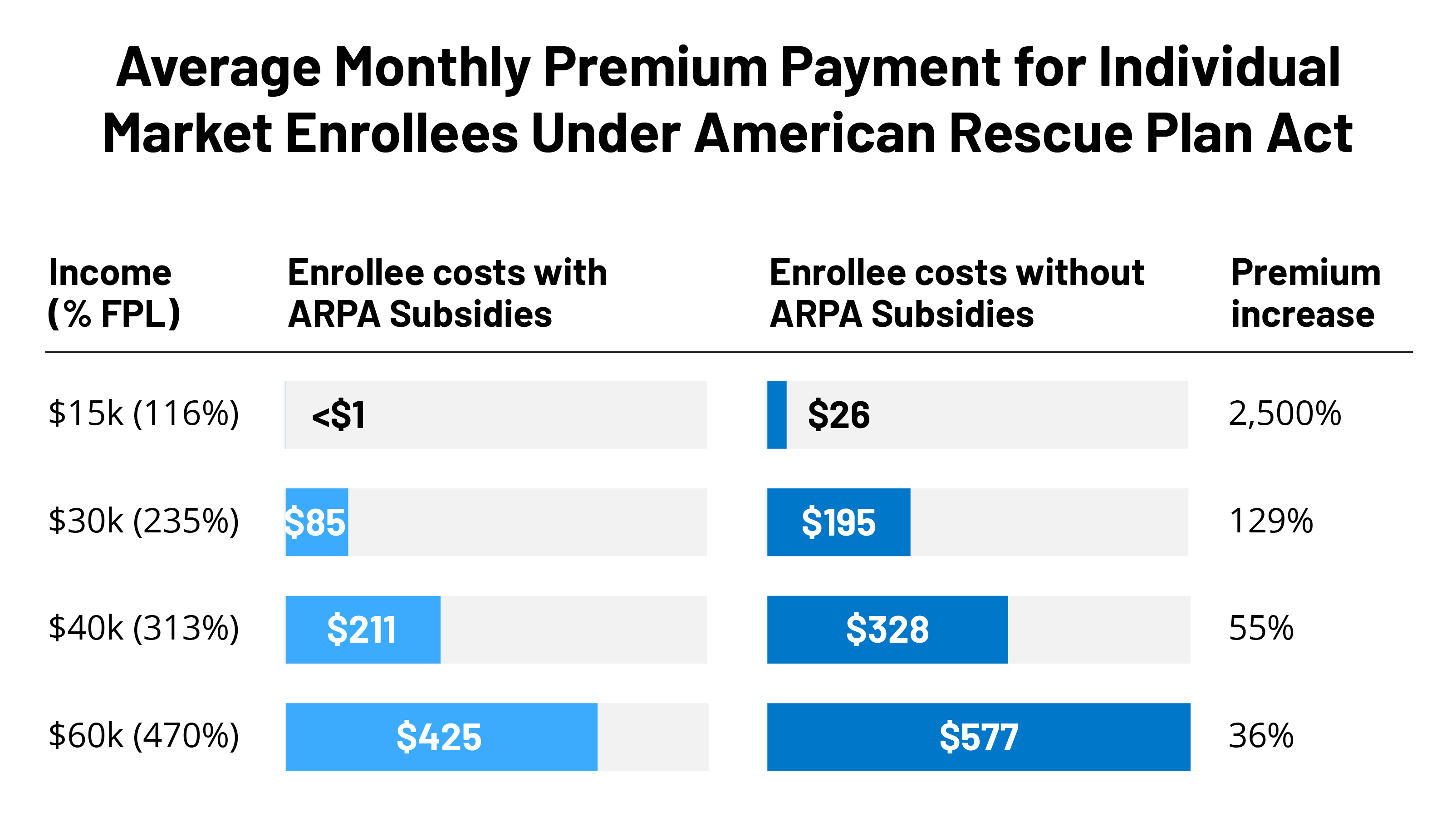

Credit: www.kff.org

Common Misconceptions

Common Misconceptions about health insurance premium subsidies can cause confusion. Understanding these misconceptions is key to making informed decisions.

Subsidies Vs. Discounts

A common misconception is that subsidies are the same as discounts. They are not. A subsidy is financial help from the government. A discount is a price reduction from the insurer. Subsidies lower your cost based on income. Discounts lower the price for everyone.

Eligibility Myths

Another myth is that only unemployed people qualify. This is not true. Many working families can get subsidies. Your income determines your eligibility, not your job status.

Some think that only families with children are eligible. This is also false. Single adults without children can qualify too.

There is also a myth that only U.S. citizens can get subsidies. Legal residents may also qualify.

| Misconception | Reality |

|---|---|

| Subsidies are like discounts | Subsidies are financial help; discounts lower prices for all |

| Only unemployed qualify | Working families may also qualify |

| Only families with children qualify | Single adults can also qualify |

| Only U.S. citizens can get subsidies | Legal residents may also qualify |

Frequently Asked Questions

What Is A Health Insurance Premium Subsidy?

A health insurance premium subsidy is financial assistance to help lower insurance costs for eligible individuals.

Who Qualifies For Premium Subsidies?

Individuals with low to moderate income levels typically qualify for premium subsidies based on federal guidelines.

How Do Premium Subsidies Work?

Premium subsidies reduce the monthly cost of health insurance, making it more affordable for eligible individuals and families.

Can I Lose My Premium Subsidy?

Yes, changes in income or household size can affect eligibility and may result in losing your premium subsidy.

Where Can I Apply For A Premium Subsidy?

You can apply for a premium subsidy through the Health Insurance Marketplace or your state’s health insurance exchange.

Conclusion

Understanding health insurance premium subsidies is crucial. These subsidies make healthcare more affordable for many. Check your eligibility to save on premiums. This support ensures better access to necessary medical services. Stay informed about your options to maximize benefits. Health insurance subsidies can significantly ease financial burdens.