Catastrophic health insurance is a high-deductible plan that covers severe medical emergencies. It offers low monthly premiums and essential health benefits.

Catastrophic health insurance is designed for young, healthy individuals or those with financial constraints. This type of insurance provides a safety net against major medical expenses while keeping premiums affordable. It typically includes three primary doctor visits per year and preventive care services.

The high deductible means you pay lower monthly premiums but must cover initial costs out-of-pocket. Ideal for those who rarely need medical attention, this plan ensures protection against unexpected, high-cost healthcare events. It aligns with the Affordable Care Act and is available to people under 30 or those with a hardship exemption.

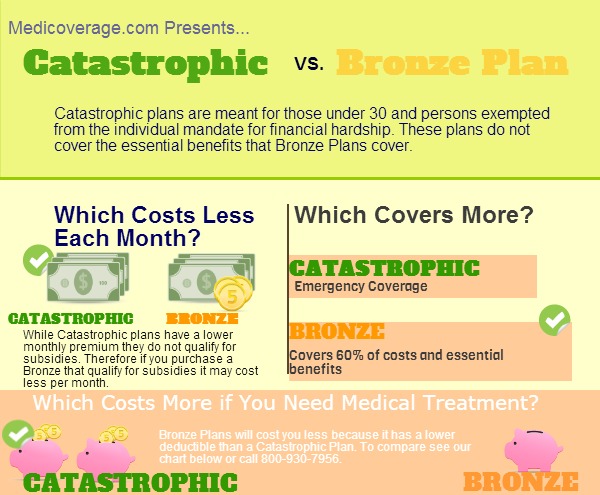

Credit: www.medicoverage.com

Introduction To Catastrophic Health Insurance

Catastrophic health insurance offers a specific type of health coverage. It is designed for emergencies and serious health issues. This type of insurance has high deductibles and lower premiums.

Definition And Purpose

Catastrophic health insurance covers major medical events. These include serious illness or accidents. The plan has low monthly premiums. But it has a high deductible. The deductible is the amount you pay before your insurance starts. This type of insurance is for worst-case scenarios. It helps avoid financial ruin due to medical emergencies.

Who Needs It?

Young adults often use catastrophic health insurance. People under 30 can qualify. It is also for those with a hardship exemption. This means they cannot afford other insurance plans.

People who are generally healthy may choose this plan. They do not expect to need regular medical care. They want protection in case of a major health event.

It can also be a good option for those with few healthcare needs. It provides peace of mind at a lower cost.

Credit: cosmoins.com

Eligibility Criteria

Understanding the eligibility criteria for catastrophic health insurance is crucial. This type of insurance is tailored for specific groups. Knowing if you qualify can help you make informed decisions.

Age And Income Limits

Catastrophic health insurance has strict age and income limits. Generally, it is available to people under 30 years old. People over 30 can also qualify if they meet specific income criteria.

| Age Group | Eligibility |

|---|---|

| Under 30 | Automatically eligible |

| 30 and older | Must meet income limits |

For those over 30, income plays a key role. They must show their income is too high for Medicaid but too low for other insurance plans.

Qualifying Life Events

Qualifying life events can make you eligible for catastrophic health insurance. These events include losing existing health coverage, moving to a new state, or changes in family size.

- Loss of health coverage

- Moving to a new state

- Changes in family size

Each event must meet specific criteria. For instance, losing health coverage must be due to job loss or end of a policy.

Being aware of these qualifying life events can help you secure catastrophic health insurance when you need it most.

Coverage Details

Catastrophic health insurance provides essential coverage for major medical emergencies. This plan is designed to protect against high costs of severe illness or injury. Let’s explore the coverage details of this insurance.

Covered Services

Catastrophic health insurance covers a wide range of services. These include:

- Emergency room visits

- Hospitalization (including surgeries)

- Primary care visits

- Specialist visits

- Preventive care (three visits per year)

- Prescription drugs

- Laboratory tests and imaging

This plan also includes essential health benefits. These benefits meet the minimum standards set by the Affordable Care Act (ACA).

Exclusions

Catastrophic health insurance has specific exclusions. These services are not covered:

- Routine dental care

- Vision care

- Maternity care

- Cosmetic surgery

- Alternative medicine

- Long-term care

Policyholders should review their plan documents. This ensures understanding of what is not covered.

Below is a table summarizing the covered and excluded services:

| Covered Services | Exclusions |

|---|---|

| Emergency room visits | Routine dental care |

| Hospitalization | Vision care |

| Primary care visits | Maternity care |

| Specialist visits | Cosmetic surgery |

| Preventive care | Alternative medicine |

| Prescription drugs | Long-term care |

| Laboratory tests and imaging |

Cost And Premiums

Catastrophic health insurance offers a safety net for major medical expenses. Understanding the costs and premiums is crucial. This section will break down the key aspects of the cost structure, including monthly premiums and out-of-pocket costs.

Monthly Premiums

The monthly premiums for catastrophic health insurance are generally lower than other plans. This makes it an attractive option for young and healthy individuals. These lower premiums provide basic coverage while keeping monthly expenses manageable.

| Age Group | Average Monthly Premium |

|---|---|

| 18-29 | $150 |

| 30-39 | $180 |

| 40-49 | $210 |

Out-of-pocket Costs

Out-of-pocket costs are higher with catastrophic plans. This includes deductibles, copayments, and coinsurance. You must meet a high deductible before the insurance starts paying.

- High deductible: Often over $8,000

- Copayments: Paid for doctor visits and prescriptions

- Coinsurance: A percentage of medical costs after deductible

While the out-of-pocket costs can be substantial, the plan covers you in emergencies. This makes it a good option for those who rarely need medical care but want coverage for unexpected events.

Pros And Cons

Catastrophic health insurance can be a lifesaver for many. But like all insurance plans, it has its own set of advantages and disadvantages. Understanding these can help you decide if it’s the right choice for you.

Advantages

- Lower Premiums: This type of insurance usually has very low monthly premiums. This can make it affordable for people with limited budgets.

- Emergency Coverage: It covers serious health issues and emergencies. This can prevent financial ruin in case of major accidents or illnesses.

- Preventive Care: Many plans cover preventive services. This includes vaccinations and screenings, which can help catch issues early.

Disadvantages

- High Deductibles: Catastrophic plans often come with high deductibles. You may need to pay a lot out-of-pocket before the insurance kicks in.

- Limited Coverage: These plans may not cover regular doctor visits or prescriptions. This can be a problem if you need frequent medical care.

- Age Restrictions: Typically, only people under 30 or those with a hardship exemption can buy these plans. This limits who can benefit from this type of insurance.

Here is a quick comparison in table format for better understanding:

| Pros | Cons |

|---|---|

| Lower premiums | High deductibles |

| Emergency coverage | Limited coverage |

| Preventive care | Age restrictions |

Credit: www.insurancefortexans.com

How To Enroll

Enrolling in catastrophic health insurance is straightforward but requires attention to detail. Here, we break down the process into simple steps. This guide covers the application process, important deadlines, and other vital information.

Application Process

Follow these steps to apply for catastrophic health insurance:

- Research Plans: Compare different catastrophic insurance plans.

- Eligibility Check: Ensure you qualify for the plan.

- Gather Documents: Collect necessary documents, such as proof of income and ID.

- Complete Application: Fill out the application form online or on paper.

- Submit Application: Send the completed application to the insurance provider.

- Await Approval: Wait for approval and further instructions from the provider.

Important Deadlines

Meeting deadlines is crucial for successful enrollment. Here are key dates to remember:

| Deadline | Description |

|---|---|

| Open Enrollment Period | The main window to apply for health insurance. |

| Special Enrollment Period | Available if you qualify for special circumstances. |

| Submission Deadline | The final date to submit your application. |

Keep these deadlines in mind to avoid missing out on coverage.

Frequently Asked Questions

What Is Catastrophic Health Insurance?

Catastrophic health insurance is a high-deductible plan covering severe illnesses or accidents. It offers low monthly premiums.

Who Is Eligible For Catastrophic Health Insurance?

Individuals under 30 or those with a hardship exemption are eligible for catastrophic health insurance plans.

What Does Catastrophic Health Insurance Cover?

It covers essential health benefits, emergency services, and preventive care. Major medical costs are also included.

How Much Does Catastrophic Health Insurance Cost?

Monthly premiums are low, but out-of-pocket costs are high due to large deductibles.

Is Catastrophic Health Insurance Worth It?

It’s beneficial for healthy individuals who want low premiums and can manage high out-of-pocket costs during emergencies.

Conclusion

Catastrophic health insurance offers a safety net for worst-case medical scenarios. It’s ideal for young, healthy individuals. While it has lower premiums, it comes with high deductibles. Weigh your needs carefully before choosing this plan. Understanding its benefits and limitations will help you make an informed decision.

Protect your future health and finances.