Car insurance can be confusing. There are many types of car insurance. One type is full coverage car insurance. But what does full coverage car insurance mean? Let’s find out!

What Does Full Coverage Car Insurance Include?

Full coverage car insurance is not just one thing. It is a combination of several types of insurance. These types work together to give you the best protection. Here is what it usually includes:

- Liability Insurance: This covers the damage you cause to others. It includes both bodily injury and property damage.

- Collision Insurance: This covers the damage to your car. It helps if you hit another car or an object.

- Comprehensive Insurance: This covers damage from events other than collisions. Examples include theft, fire, and natural disasters.

- Medical Payments or Personal Injury Protection (PIP): This covers your medical expenses. It can also cover lost wages if you are hurt in an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if the other driver has no insurance. It also helps if their insurance is not enough to cover the damage.

Why Do You Need Full Coverage Car Insurance?

Full coverage car insurance offers many benefits. Here are some reasons why you might need it:

- Peace of Mind: You can drive without worrying about accidents. You know you are protected.

- Financial Protection: Accidents can be expensive. Full coverage helps you avoid huge costs.

- Loan or Lease Requirements: Lenders often require full coverage. This protects their investment in your car.

- Comprehensive Protection: Full coverage protects you from many types of damage. This includes collisions, theft, and natural disasters.

How Much Does Full Coverage Car Insurance Cost?

The cost of full coverage car insurance varies. It depends on several factors. These include:

- Your Driving Record: If you have a clean record, you might pay less.

- Your Car: Expensive cars cost more to insure.

- Your Location: Some areas have higher rates of accidents and theft.

- Your Age: Younger drivers often pay more.

- Your Deductible: A higher deductible can lower your premium.

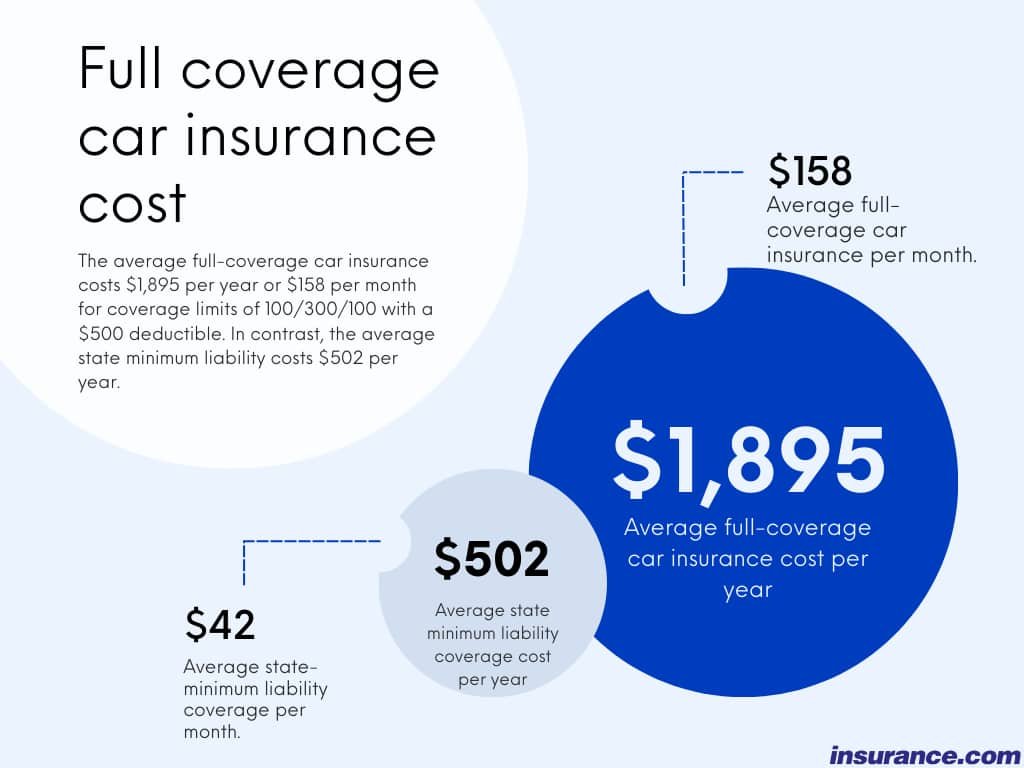

On average, full coverage can cost between $1,000 and $2,000 per year. But remember, prices can vary widely.

Credit: www.valuepenguin.com

Is Full Coverage Car Insurance Worth It?

Whether full coverage car insurance is worth it depends on your situation. Here are some things to consider:

- Your Car’s Value: If your car is new or expensive, full coverage is often worth it.

- Your Financial Situation: Can you afford to pay for repairs or a new car out of pocket?

- Your Risk Tolerance: Are you comfortable taking the risk of not having full coverage?

If you need peace of mind and financial protection, full coverage can be a good choice.

How to Choose the Right Full Coverage Car Insurance

Choosing the right full coverage car insurance is important. Here are some steps to help you:

- Compare Quotes: Get quotes from multiple insurance companies. Compare the coverage and prices.

- Check Reviews: Read reviews to see what other customers think. Look for companies with good customer service.

- Ask About Discounts: Many companies offer discounts. These can help you save money.

- Review Coverage Options: Make sure the policy covers everything you need.

Take your time and choose the policy that best fits your needs.

Frequently Asked Questions

| Question | Answer |

|---|---|

| Is full coverage car insurance mandatory? | No, but it is often required for leased or financed cars. |

| Does full coverage car insurance cover rental cars? | It depends on your policy. Check with your insurance company. |

| Can I drop full coverage on an old car? | Yes, but consider your ability to pay for repairs or a new car. |

Credit: howmuch.net

Frequently Asked Questions

What Does Full Coverage Car Insurance Include?

Full coverage typically includes liability, collision, and comprehensive insurance, offering extensive protection for various incidents.

Is Full Coverage Car Insurance Mandatory?

Full coverage is not mandatory but is often required by lenders for financed or leased vehicles.

How Much Does Full Coverage Cost?

Costs vary based on factors like vehicle type, driving history, and location. On average, it can be higher than basic coverage.

Does Full Coverage Cover Rental Cars?

Yes, full coverage often includes rental car coverage, but it’s best to check your specific policy details.

Can I Customize Full Coverage Car Insurance?

Many insurers allow customization of full coverage policies to better fit your specific needs and budget.

Conclusion

Full coverage car insurance offers comprehensive protection. It includes liability, collision, and comprehensive insurance. It also covers medical payments and uninsured motorist coverage. While it can be more expensive, it provides peace of mind and financial protection. Consider your car’s value, your financial situation, and your risk tolerance. Follow the steps to choose the right policy for you. With full coverage, you can drive with confidence, knowing you are protected.