Health Insurance Open Enrollment is a specific period when individuals can sign up for or change their health insurance plans. This window usually occurs once a year.

Understanding Health Insurance Open Enrollment is crucial for securing the best coverage. During this period, you can enroll in new health insurance plans or make changes to existing ones. Missing this window often means waiting another year for the next opportunity, unless you qualify for a Special Enrollment Period.

This limited timeframe ensures that everyone gets a chance to review their healthcare needs and make informed decisions. Employers, marketplaces, and private insurers all have their own open enrollment periods, so it’s important to be aware of the specific dates relevant to your situation.

Credit: lchcommunityhealth.org

Introduction To Open Enrollment

Understanding health insurance can be confusing. One key term to know is Open Enrollment. This is a specific period each year where you can sign up for health insurance. It’s crucial to understand what it is and why it matters.

Defining Open Enrollment

Open Enrollment is a set time frame to apply for health insurance. During this period, you can:

- Enroll in a new health insurance plan

- Change your existing plan

- Drop your current plan

Missing this window means you might not get coverage. Exceptions are made only for certain life events.

Importance Of Open Enrollment

Open Enrollment ensures everyone has access to health insurance. It allows you to make necessary changes to your plan. Here’s why it’s important:

- Access to Care: Ensures you have coverage for medical needs.

- Financial Protection: Helps avoid high medical costs.

- Plan Adjustments: Allows you to change plans to better suit your needs.

Mark your calendar for Open Enrollment dates. This way, you won’t miss your chance to get or change your coverage.

Credit: www.pfichicago.com

When Open Enrollment Occurs

Understanding when open enrollment occurs is crucial for securing health insurance. This period allows individuals to sign up for or change their health plans. Missing this window can lead to limited options.

Typical Timeframes

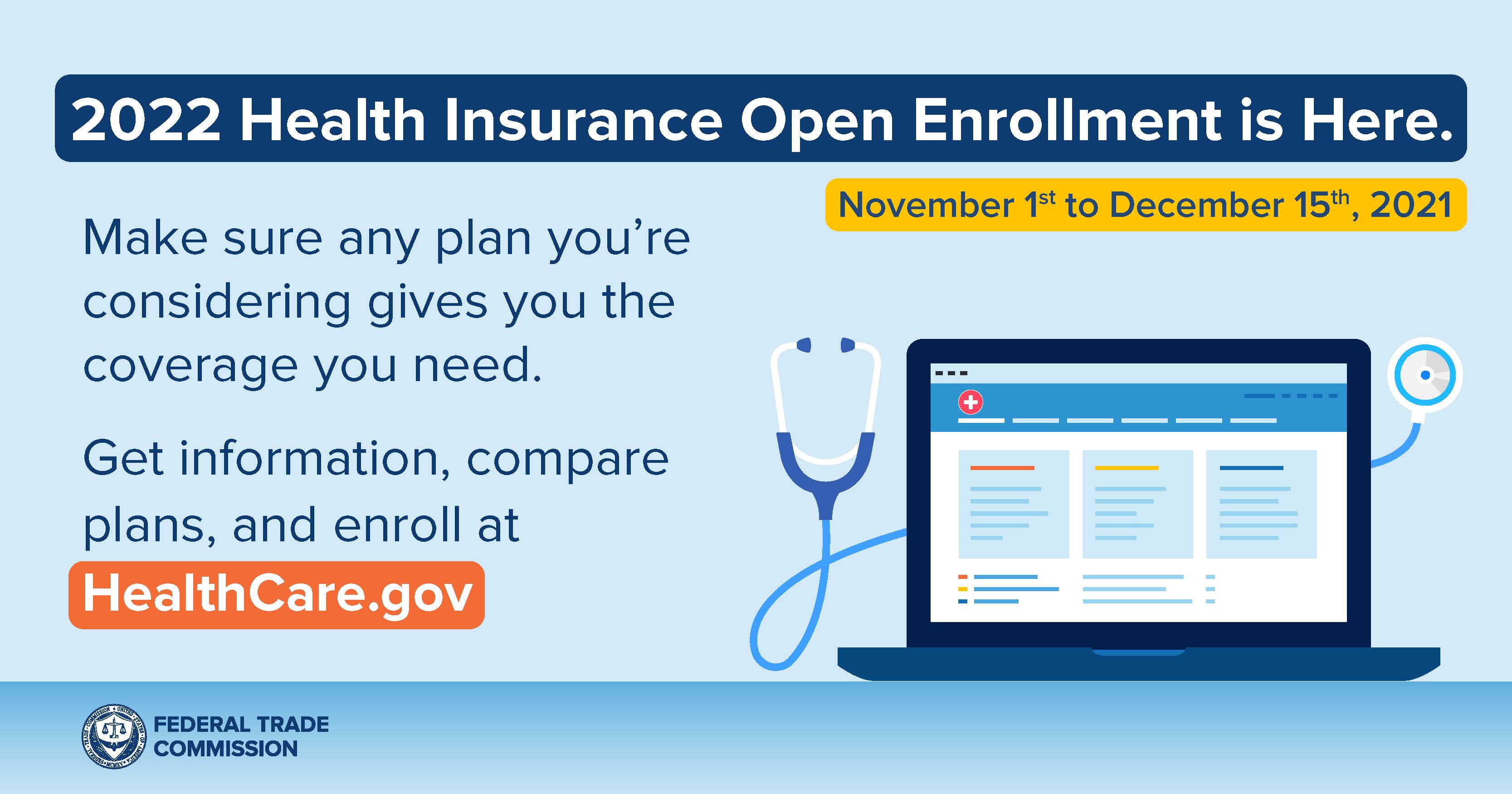

Open enrollment usually happens once a year. The specific dates can vary. For example, the federal marketplace typically runs from November 1 to December 15. Some state-run exchanges have different dates. It’s important to check the specific timeframe for your state.

| Marketplace | Open Enrollment Period |

|---|---|

| Federal Marketplace | November 1 – December 15 |

| State-run Exchanges | Varies by State |

Special Enrollment Periods

Missed the open enrollment? Don’t worry, special enrollment periods (SEPs) offer another chance. SEPs are triggered by certain life events. These can include:

- Marriage

- Birth of a child

- Losing other health coverage

- Moving to a new area

Each event has its own rules and timeframes. It’s vital to act quickly after a qualifying event. Usually, you have 60 days from the event to enroll.

Choosing The Right Plan

Choosing the right health insurance plan can be challenging. During the Open Enrollment Period, you have the opportunity to select a plan that suits your needs. This section will guide you through the process of making an informed decision.

Assessing Your Needs

First, evaluate your healthcare needs. Consider the following factors:

- Your current health status

- Any ongoing medical conditions

- Prescription medications

- Preferred doctors and hospitals

Create a list of these needs. This will help you compare plans effectively.

Comparing Plan Options

Next, compare the available plans. Focus on these key elements:

| Plan Feature | Description |

|---|---|

| Premiums | The monthly cost you pay for the plan. |

| Deductibles | Amount you pay before your insurance starts covering costs. |

| Copayments | Fixed amount you pay for services. |

| Network | Doctors and hospitals included in the plan. |

| Coverage | Services and treatments the plan covers. |

Use this information to create a shortlist of plans. Then, consider the following:

- Match the plan’s network with your preferred doctors.

- Ensure the plan covers your prescriptions.

- Check if the plan offers additional benefits.

By assessing your needs and comparing plan options, you can choose the right health insurance plan during the Open Enrollment Period.

Credit: consumer.ftc.gov

Common Mistakes To Avoid

Understanding health insurance open enrollment is crucial. Avoiding common mistakes ensures you get the best coverage. Here are some common pitfalls people face during this period.

Procrastination

Procrastination can lead to missed opportunities. Many people wait until the last minute. This rush often results in poor decisions. It’s best to start early. Review your current plan and explore new options. This ensures you have enough time to choose wisely.

- Start reviewing plans early.

- Set reminders for important dates.

- Gather necessary documents beforehand.

Ignoring Plan Details

Ignoring plan details is a common mistake. Each plan has unique benefits and drawbacks. Always read the fine print. Pay close attention to:

| Aspect | Details to Check |

|---|---|

| Premiums | Monthly cost of the plan |

| Deductibles | Amount you pay before insurance kicks in |

| Network | List of doctors and hospitals covered |

| Coverage | Services and treatments included |

By understanding these details, you avoid unexpected costs. Ensure the plan meets your needs.

How To Enroll

Enrolling in health insurance during the Open Enrollment period is crucial. This process ensures you have coverage for the upcoming year. Below, you’ll find clear steps on how to enroll, whether online or via paper forms.

Online Enrollment

Many find online enrollment quick and easy. Follow these steps to enroll online:

- Visit the official health insurance marketplace website.

- Create an account or log in if you already have one.

- Enter your personal information as prompted.

- Select the plan that best fits your needs.

- Review and confirm your choices.

After completing these steps, you will receive a confirmation email. Ensure all your details are correct to avoid issues.

Paper Enrollment

If you prefer traditional methods, paper enrollment is an option. Here’s how to enroll using paper forms:

- Request a paper application from your health insurance provider.

- Fill out the application with accurate details.

- Double-check the information to ensure it is correct.

- Mail the completed form to the provided address.

- Wait for a confirmation letter from the insurance provider.

Make sure you send your application early. This ensures it arrives before the deadline.

Both online and paper enrollment methods have their benefits. Choose the method that suits you best.

After Enrollment

Once you have chosen your health insurance plan, what comes next? Understanding the steps after enrollment can help you use your benefits effectively. This section will guide you through the process of confirming your coverage and making any necessary changes.

Confirming Coverage

After enrolling, it is crucial to confirm that your coverage is active. You should receive a welcome packet and insurance cards within a few weeks. If you don’t receive these, contact your insurance provider immediately.

Here are steps to confirm your coverage:

- Check your mail for the welcome packet.

- Verify the details on your insurance card.

- Log into your insurance account online.

- Contact customer service for confirmation.

Making Changes

Sometimes you need to make changes after enrollment. You might need to update your information or switch plans.

Here are ways to make changes:

- Log into your online account.

- Navigate to the ‘My Profile’ section.

- Update personal information as needed.

- Contact customer service to switch plans.

Remember, making changes can affect your coverage. Always double-check with your provider.

Frequently Asked Questions

What Is Health Insurance Open Enrollment?

Health insurance open enrollment is a period when you can sign up for or change your health insurance plan.

When Does Open Enrollment Start?

Open enrollment usually starts in early November and ends in mid-December for coverage starting the following year.

Who Is Eligible For Open Enrollment?

Anyone who needs health insurance can participate in open enrollment, including those changing plans or enrolling for the first time.

Can I Change Plans During Open Enrollment?

Yes, you can switch to a different health insurance plan during the open enrollment period.

What Happens If I Miss Open Enrollment?

If you miss open enrollment, you may need to wait until the next period unless you qualify for a special enrollment period.

Conclusion

Understanding health insurance open enrollment is crucial. It allows you to choose the best coverage for your needs. Don’t miss this annual opportunity to secure your health and financial well-being. Stay informed and make timely decisions. Proper planning can save you money and ensure you have the right protection.