Long-term health insurance provides coverage for extended care not covered by regular health insurance. It includes services like nursing home care and in-home assistance.

Long-term health insurance is crucial for people who anticipate needing extended care due to chronic illnesses, disabilities, or aging. Traditional health insurance typically covers only short-term medical needs and may leave significant gaps. Long-term health insurance helps fill these gaps, offering peace of mind and financial security.

It ensures that individuals receive the necessary support and care for an extended period, whether at home or in specialized facilities. This type of insurance can significantly ease the financial burden on families, making it an essential consideration for long-term health planning.

Credit: www.kiplinger.com

Introduction To Long-term Health Insurance

Long-term health insurance is a crucial part of your health plan. It ensures you get care when you can’t care for yourself. This type of insurance covers extended medical care costs.

Definition

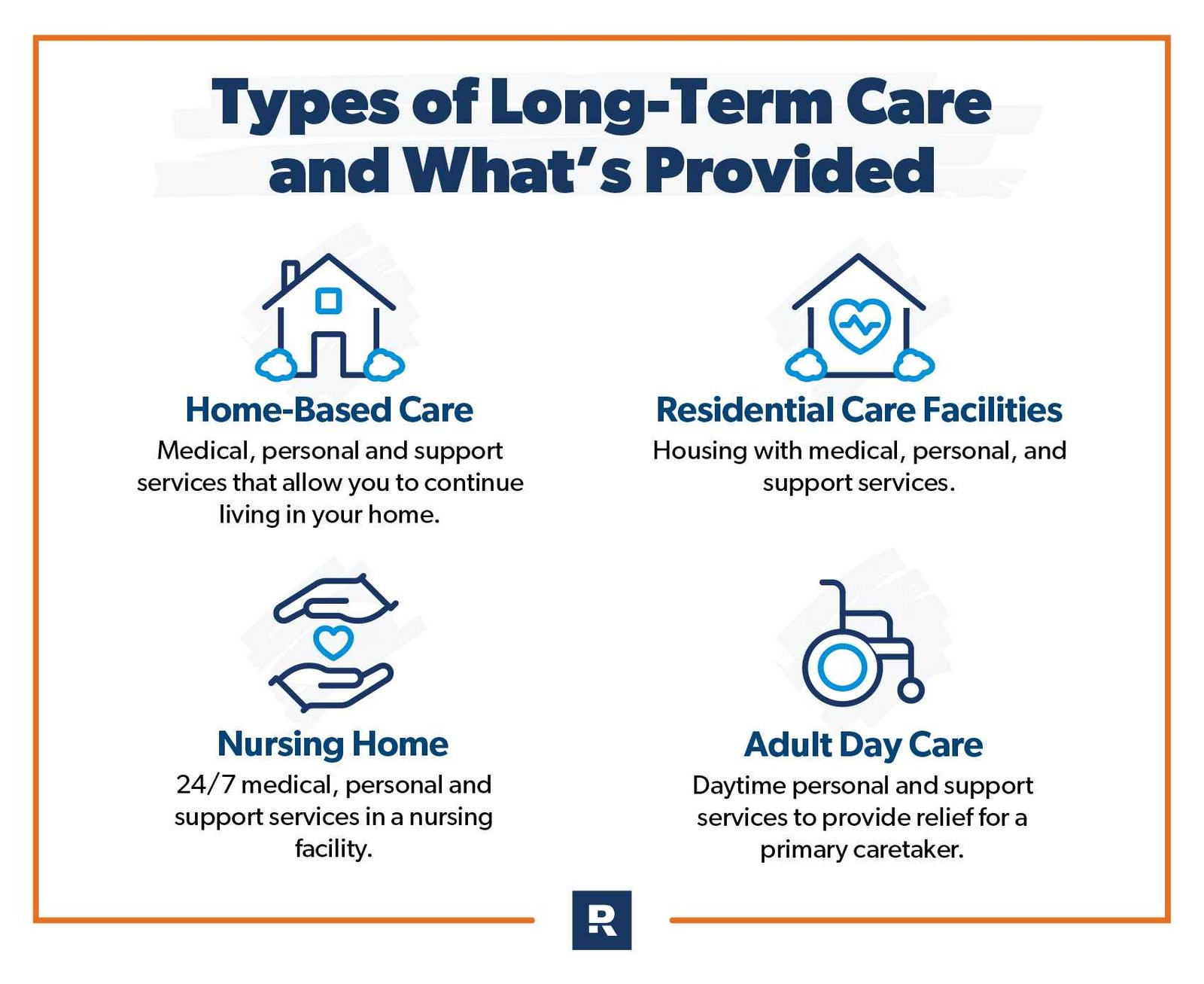

Long-term health insurance provides coverage for chronic illnesses and disabilities. It helps pay for services not covered by regular health insurance. These services include home care, nursing home care, and adult day care.

Importance

Understanding the importance of long-term health insurance is vital. As people age, they may need help with daily activities. This insurance can cover these costs, reducing financial stress.

It also helps families manage the care of loved ones. Without it, the costs can be overwhelming. Having a policy can offer peace of mind and financial security.

Credit: www.decent.com

Key Features

Understanding the key features of long-term health insurance is essential. This insurance helps cover prolonged health care needs. Below are some critical aspects to consider.

Coverage Options

Long-term health insurance offers various coverage options. These options cater to different needs and preferences. Here are some common types:

- Nursing Home Care: Covers expenses for staying in a nursing home.

- Home Health Care: Pays for medical services at home.

- Assisted Living Facilities: Covers costs for assisted living services.

- Adult Day Care: Pays for daytime care in specialized centers.

Each option has unique benefits. Choose the one that best fits your situation.

Policy Terms

Policy terms refer to the specific conditions of your insurance. These terms define how your policy works. Key elements include:

| Element | Description |

|---|---|

| Benefit Period | The length of time benefits will be paid. |

| Elimination Period | The waiting period before benefits begin. |

| Inflation Protection | Adjusts benefits to keep up with inflation. |

| Premium Costs | The amount you pay for your policy. |

Understanding these terms is crucial for maximizing your policy’s benefits.

Eligibility Criteria

Understanding the eligibility criteria for long-term health insurance is crucial. Knowing who can apply saves time and effort. Here are the main factors:

Age Requirements

The age of applicants plays a big role in eligibility. Long-term health insurance often has specific age limits. Here’s a simple breakdown:

| Age Group | Eligibility Status |

|---|---|

| 18-30 | Eligible |

| 31-50 | Eligible |

| 51-65 | Eligible |

| 66 and above | Limited eligibility |

Health Assessments

Health assessments are often required. These tests determine the current health status of applicants. Here’s what to expect:

- Medical History: A review of past illnesses and treatments.

- Physical Exam: Doctors check vital signs like blood pressure.

- Lab Tests: Blood and urine tests may be conducted.

- Mental Health: A mental health evaluation might be needed.

These assessments help insurers understand risk. They ensure the applicant is fit for coverage. Not all applicants may pass these tests. Those who do can enjoy the benefits of long-term health insurance.

Benefits

Long-term health insurance provides several significant benefits. It offers peace of mind and protection against unexpected health expenses. Below, we explore the key benefits in detail.

Financial Security

Long-term health insurance ensures financial security during health crises. It covers medical expenses and reduces financial strain. This insurance helps maintain your savings and assets.

With long-term health insurance, you avoid high out-of-pocket costs. It covers hospital stays, surgeries, and other treatments. This protection is essential for long-term planning.

Comprehensive Care

Long-term health insurance provides comprehensive care. It covers a wide range of medical services. These include preventive care, emergency services, and prescription drugs.

The insurance also supports chronic condition management. This ensures regular check-ups and medications are covered. It helps maintain a high quality of life over time.

Additionally, long-term health insurance often includes mental health services. This holistic approach ensures all health needs are met.

| Benefits | Description |

|---|---|

| Financial Security | Reduces financial strain from medical expenses. |

| Comprehensive Care | Covers a wide range of medical services. |

Choosing The Right Plan

Choosing the right long-term health insurance plan can be tricky. You need to think about many factors. This includes comparing providers and evaluating costs. It is essential to pick a plan that fits your needs and budget.

Comparing Providers

When comparing providers, consider the following:

- Reputation: Check reviews and ratings of the insurance company.

- Coverage: Look at what services the plan covers.

- Network: Ensure your preferred doctors and hospitals are in the network.

- Customer Service: Good support can make a big difference.

Here is a table to help you compare providers:

| Provider | Reputation | Coverage | Network | Customer Service |

|---|---|---|---|---|

| Provider A | 4.5 stars | Comprehensive | Wide | Excellent |

| Provider B | 4.0 stars | Moderate | Moderate | Good |

| Provider C | 3.5 stars | Basic | Narrow | Average |

Evaluating Costs

Evaluating costs is crucial. You need to ensure the plan is affordable. Consider these costs:

- Premiums: The amount you pay each month.

- Deductibles: The amount you pay before insurance kicks in.

- Co-pays: The fee you pay for each visit or service.

- Out-of-pocket Maximum: The most you will pay in a year.

Here is an example of cost evaluation:

| Cost Type | Provider A | Provider B | Provider C |

|---|---|---|---|

| Premium | $200/month | $150/month | $100/month |

| Deductible | $1,000/year | $1,500/year | $2,000/year |

| Co-pay | $20/visit | $25/visit | $30/visit |

| Out-of-pocket Max | $5,000 | $6,000 | $7,000 |

Make sure to weigh these costs against the benefits provided. This will help you choose the best long-term health insurance plan.

Credit: www.plansponsor.com

Common Misconceptions

Understanding Long-Term Health Insurance can be complex. Many people have incorrect ideas about it. These misconceptions can lead to poor decisions. Let’s clear up some of these common myths.

Myths Vs. Reality

Many believe that Long-Term Health Insurance is only for the elderly. This is not true. Anyone, at any age, can need long-term care. Accidents or illnesses can happen to anyone.

Another common myth is that health insurance covers long-term care. This is false. Regular health insurance doesn’t cover long-term care costs. You need specific insurance for that.

Clarifications

People often think that Medicare will pay for long-term care. This is a misconception. Medicare only covers short-term care, not long-term.

Some believe that they can save enough to cover these costs. This can be risky. Long-term care is very expensive. Savings might not be enough.

| Myth | Reality |

|---|---|

| Only the elderly need long-term care. | Anyone can need it, young or old. |

| Health insurance covers long-term care. | Regular health insurance doesn’t cover it. |

| Medicare pays for long-term care. | Medicare only covers short-term care. |

| Savings can cover long-term care costs. | Long-term care is very expensive. Savings might fall short. |

- Myth: Only elderly people need long-term care.

- Reality: Anyone can need long-term care due to accidents or illnesses.

- Myth: Health insurance covers long-term care.

- Reality: Regular health insurance does not cover long-term care costs.

- Myth: Medicare will pay for long-term care.

- Reality: Medicare only covers short-term care, not long-term.

- Myth: I can save enough to cover long-term care costs.

- Reality: Long-term care is very expensive and savings might not be enough.

Understanding these misconceptions can help you make better decisions about Long-Term Health Insurance. Knowing the facts ensures you are better prepared for the future.

Frequently Asked Questions

What Is Long-term Health Insurance?

Long-term health insurance covers prolonged medical care, often for chronic illnesses or disabilities, beyond standard health insurance.

Who Needs Long-term Health Insurance?

Individuals with chronic conditions, disabilities, or those planning for future healthcare needs might benefit from long-term health insurance.

How Does Long-term Health Insurance Work?

It provides coverage for extended medical care, including nursing homes, assisted living, and in-home care services, typically after a waiting period.

What Does Long-term Health Insurance Cover?

It covers services like nursing home care, home health care, assisted living, and personal care, which standard health insurance often excludes.

Is Long-term Health Insurance Worth It?

For those anticipating future chronic care needs, it can offer financial security and peace of mind, making it a valuable investment.

Conclusion

Long-term health insurance is a crucial consideration for future medical needs. It offers peace of mind and financial security. Understanding its benefits and coverage options is essential. Make informed decisions to protect your health and finances. Investing in long-term health insurance ensures you are prepared for unexpected medical expenses.