Non-owner car insurance is a special type of insurance. It covers drivers who don’t own a car. This type of insurance is useful for many reasons.

Credit: www.mychoice.ca

Why Do You Need Non-Owner Car Insurance?

There are many reasons you might need non-owner car insurance. Here are some examples:

- You often borrow cars from friends or family.

- You rent cars frequently for work or travel.

- You need insurance to keep your driver’s license valid.

This type of insurance can help in these situations. It offers peace of mind and protection.

Benefits Of Non-owner Car Insurance

Non-owner car insurance has many benefits. Here are a few:

| Benefit | Description |

|---|---|

| Liability Coverage | Covers damages and injuries you cause in an accident. |

| Legal Requirements | Helps you meet state insurance laws. |

| Peace of Mind | You are covered even when driving someone else’s car. |

Credit: serenitygroup.com

How Does Non-Owner Car Insurance Work?

Non-owner car insurance is different from regular car insurance. Here is how it works:

- You buy the insurance policy from an insurance company.

- You pay a monthly or yearly premium for the coverage.

- If you are in an accident, the insurance helps cover costs.

This is a simple and effective way to stay protected.

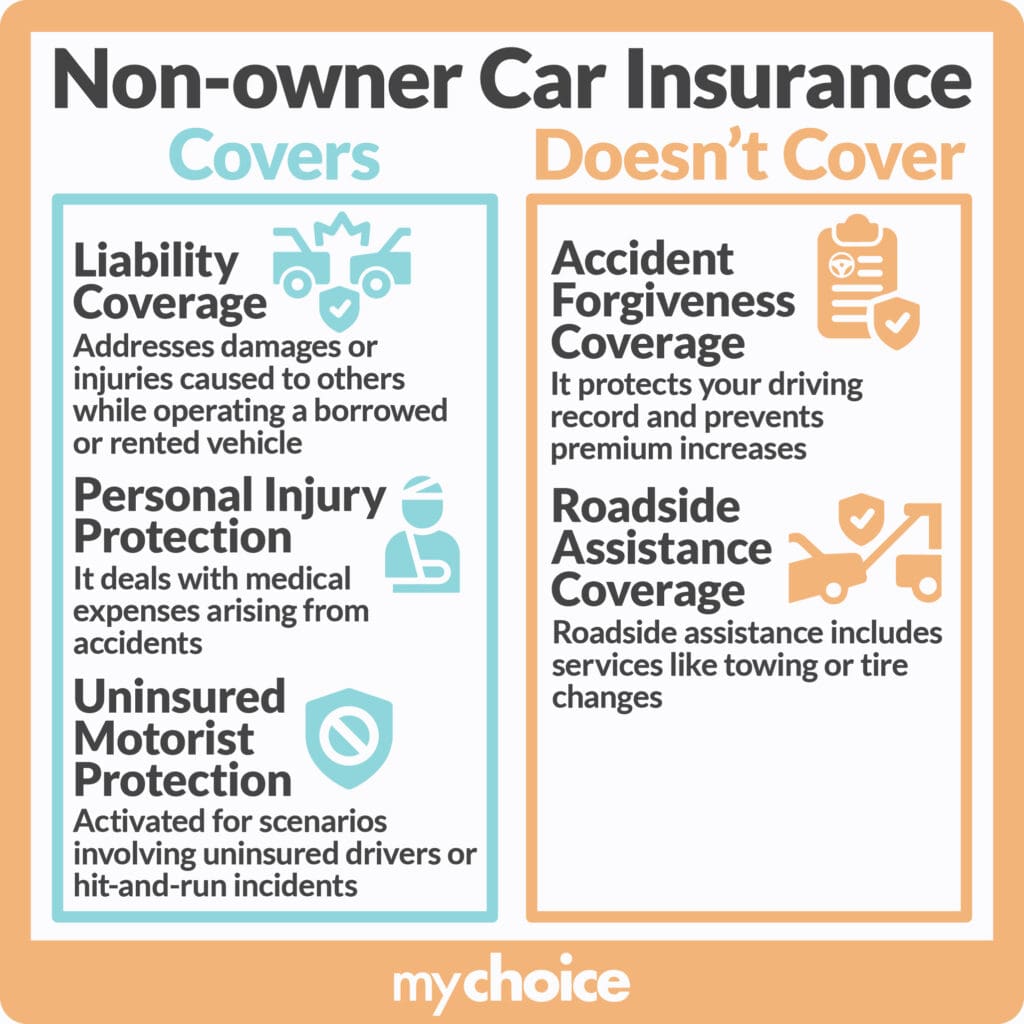

What Does Non-owner Car Insurance Cover?

Non-owner car insurance covers several things:

- Liability for bodily injury: This covers medical expenses for injuries you cause.

- Liability for property damage: This covers damage to other people’s property.

- Uninsured/underinsured motorist coverage: This protects you if the other driver doesn’t have enough insurance.

It is important to know what is covered. This helps you understand your protection.

What Non-Owner Car Insurance Does Not Cover

Non-owner car insurance does not cover everything. Here is what it usually does not cover:

- Damage to the car you are driving.

- Personal injuries to you.

- Personal belongings inside the car.

Knowing these limits is important. It helps you make the best decisions.

Who Should Consider Non-owner Car Insurance?

Non-owner car insurance is not for everyone. Here are some people who should consider it:

- People who rent cars often.

- People who borrow cars from friends or family.

- People who need to keep their license active.

If you fall into these categories, this insurance can be very helpful.

How to Get Non-Owner Car Insurance

Getting non-owner car insurance is simple. Here are the steps:

- Contact an insurance company.

- Ask for a non-owner car insurance quote.

- Provide your personal information.

- Choose the coverage you need.

- Pay the premium.

Once you complete these steps, you will have your policy. It’s easy to get started.

Cost Of Non-owner Car Insurance

The cost of non-owner car insurance varies. Here are some factors that affect the cost:

- Your driving history.

- Your age and gender.

- The amount of coverage you choose.

It’s important to shop around. Compare quotes from different companies. This helps you find the best price.

Frequently Asked Questions

What Is Non-owner Car Insurance?

Non-owner car insurance provides liability coverage when driving a car you don’t own.

Who Needs Non-owner Car Insurance?

Non-owner car insurance is ideal for those who frequently rent or borrow cars.

Does Non-owner Car Insurance Cover Rental Cars?

Yes, it typically covers liability for rental cars, but not damage to the rental vehicle.

How Much Does Non-owner Car Insurance Cost?

The cost varies, but it’s usually less expensive than standard auto insurance.

Can I Get Non-owner Insurance With A Dui?

Yes, you can obtain non-owner car insurance even if you have a DUI on your record.

Conclusion

Non-owner car insurance is a great option. It offers protection for drivers who don’t own a car. It’s easy to get and can save you from big expenses. If you often borrow or rent cars, consider getting this insurance. It provides peace of mind and meets legal requirements. Stay safe on the road!