Car insurance can be expensive. Pay-Per-Mile car insurance offers a new way to save money. But what exactly is it?

Understanding Pay-Per-Mile Car Insurance

Pay-Per-Mile car insurance is a type of auto insurance. It charges you based on the miles you drive. The less you drive, the less you pay.

Credit: www.nerdwallet.com

Credit: www.cmtelematics.com

How Does Pay-Per-Mile Car Insurance Work?

Pay-Per-Mile car insurance has two main parts:

- A base rate

- A per-mile rate

The base rate is a fixed monthly fee. The per-mile rate is a charge for each mile you drive.

Example Calculation

Let’s say your base rate is $30 per month. Your per-mile rate is 5 cents per mile. If you drive 100 miles in a month, your total cost will be:

| Base Rate | Per-Mile Rate | Miles Driven | Total Cost |

|---|---|---|---|

| $30 | 5 cents | 100 miles | $35 |

This means you only pay $35 for that month!

Benefits of Pay-Per-Mile Car Insurance

There are many benefits to Pay-Per-Mile car insurance:

- Cost Savings: You pay less if you drive less.

- Fair Pricing: You pay for what you use.

- Encourages Less Driving: Helps reduce traffic and pollution.

- Flexible: Great for people who drive occasionally.

Who Should Consider Pay-Per-Mile Car Insurance?

Pay-Per-Mile car insurance is not for everyone. It works best for:

- People who drive less than 10,000 miles a year.

- City dwellers who use public transport often.

- Retirees who drive occasionally.

- Work-from-home employees.

How to Get Pay-Per-Mile Car Insurance

Getting Pay-Per-Mile car insurance is easy. Follow these simple steps:

- Research insurance companies that offer Pay-Per-Mile policies.

- Compare rates and coverage options.

- Request a quote from the company.

- Install a mileage tracking device in your car.

- Start paying based on your miles driven.

FAQs about Pay-Per-Mile Car Insurance

Is Pay-per-mile Car Insurance Reliable?

Yes, it is reliable. Many reputable companies offer it. Your coverage is the same as traditional insurance.

How Is Mileage Tracked?

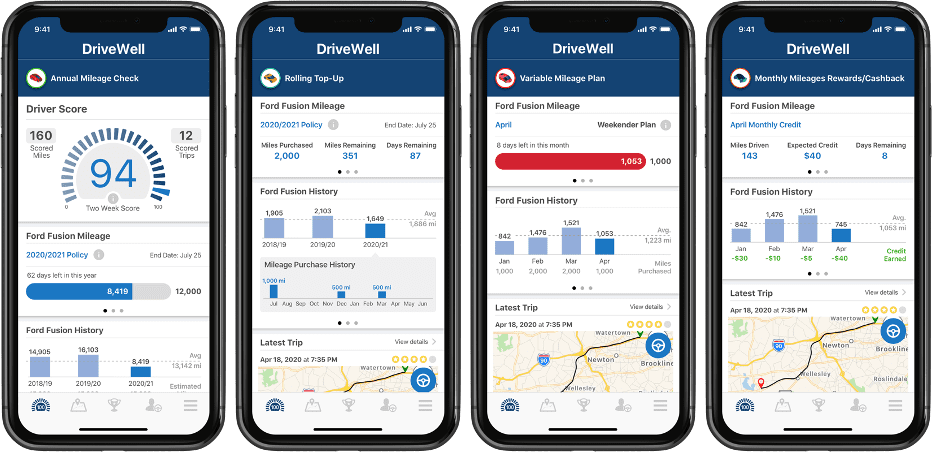

A device is installed in your car. It tracks the miles you drive. Some companies use a smartphone app instead.

What Happens If I Drive More Than Expected?

You will pay more if you drive more. But, you still have coverage. You just pay for the extra miles driven.

Is It Easy To Switch To Pay-per-mile Car Insurance?

Yes, switching is easy. Contact a company that offers Pay-Per-Mile insurance. They will guide you through the process.

Frequently Asked Questions

What Is Pay-per-mile Car Insurance?

Pay-Per-Mile Car Insurance is a policy where you pay based on the miles you drive.

How Does Pay-per-mile Insurance Work?

Pay-Per-Mile Insurance charges a base rate plus a per-mile fee.

Who Benefits From Pay-per-mile Insurance?

Low-mileage drivers benefit most from Pay-Per-Mile Insurance due to potential cost savings.

Is Pay-per-mile Insurance Cheaper?

For drivers with low annual mileage, Pay-Per-Mile Insurance can be cheaper than traditional policies.

How Are Miles Tracked In Pay-per-mile Insurance?

Miles are tracked using a small device installed in your car or via a mobile app.

Conclusion

Pay-Per-Mile car insurance is a great option for low-mileage drivers. It offers cost savings, fair pricing, and flexibility. If you drive less, you should consider this type of insurance.

Remember to research and compare different companies. Find the best rate and coverage for your needs. Happy driving!