Short-term health insurance provides temporary coverage for unexpected medical needs. It typically lasts from one month to a year.

Short-term health insurance is a flexible option for those needing temporary coverage. It suits people between jobs, recent graduates, or those waiting for other insurance to begin. Plans usually offer lower premiums but higher out-of-pocket costs. Coverage varies, often excluding pre-existing conditions and comprehensive benefits.

It’s crucial to read the policy details to understand limitations and exclusions. Short-term plans can be a quick solution for immediate health insurance needs, but they are not a long-term substitute for comprehensive health plans. Always compare different options to find the best fit for your specific situation.

Credit: www.wealthguards.com

Introduction To Short-term Health Insurance

Short-term health insurance can be a lifesaver. It helps during unexpected gaps in coverage. These plans offer temporary relief. They are not meant to replace long-term health insurance. Understanding the basics is key.

Definition

Short-term health insurance is temporary coverage. It lasts for a limited period. Usually, it covers from a few months up to a year. These plans offer limited benefits. They are not as comprehensive as regular health insurance. They fill the gap between other insurance plans.

Purpose

The purpose of short-term health insurance is simple. It provides temporary health coverage. This is useful during transitions. For example, changing jobs or graduating from college. It helps to avoid gaps in health coverage. Short-term plans can also be helpful if you miss open enrollment.

| Scenario | Short-Term Health Insurance Benefit |

|---|---|

| Job Change | Provides coverage until new job insurance starts. |

| College Graduation | Covers you until you get a full-time job. |

| Missed Open Enrollment | Helps you avoid a gap in health insurance. |

Short-term health insurance is not for everyone. It covers basic health needs. But it often excludes pre-existing conditions. This insurance is affordable. But it doesn’t provide comprehensive coverage. Always read the fine print.

- Temporary coverage up to one year

- Useful during job transitions

- Affordable but limited

- Excludes pre-existing conditions

Credit: www.uhc.com

Key Features

Short-term health insurance offers temporary coverage. It bridges gaps in your regular health insurance. Let’s dive into its key features.

Coverage Period

Short-term health insurance plans typically have a limited coverage period. This period usually ranges from 30 days to 12 months. You can renew the plan, but it has a limit. Some states allow up to three renewals. Always check your state laws for specifics.

Eligibility

Eligibility for short-term health insurance is straightforward. These plans are open to most individuals. There are minimal restrictions. Applicants must pass a basic health questionnaire. Pre-existing conditions may not be covered. These plans are ideal for those in transition. For example:

- Recent graduates

- People between jobs

- Waiting for employer coverage

- Retiring early

Short-term health insurance is flexible. It’s a great option for temporary needs. Make sure to read the plan details carefully.

Benefits

Short-term health insurance offers numerous benefits for individuals needing temporary coverage. These plans can be a lifesaver in specific situations. Let’s explore some key advantages.

Affordability

One of the primary benefits of short-term health insurance is its affordability. These plans often have lower premiums. This makes them a cost-effective choice for many.

Here’s a quick comparison of costs:

| Plan Type | Monthly Premium |

|---|---|

| Short-Term Insurance | $50 – $200 |

| Standard Insurance | $300 – $600 |

As shown, short-term plans typically cost less. This makes them accessible to those on a tight budget.

Flexibility

Short-term health insurance provides significant flexibility. You can choose the length of the coverage period. This ranges from one month to a year.

- Customizable duration

- Various deductible options

- Multiple coverage levels

This flexibility ensures the plan fits your specific needs. You can adjust the plan as your situation changes.

Additionally, enrollment is usually quick and straightforward. There are fewer restrictions compared to standard plans.

Credit: www.hemophiliafed.org

Limitations

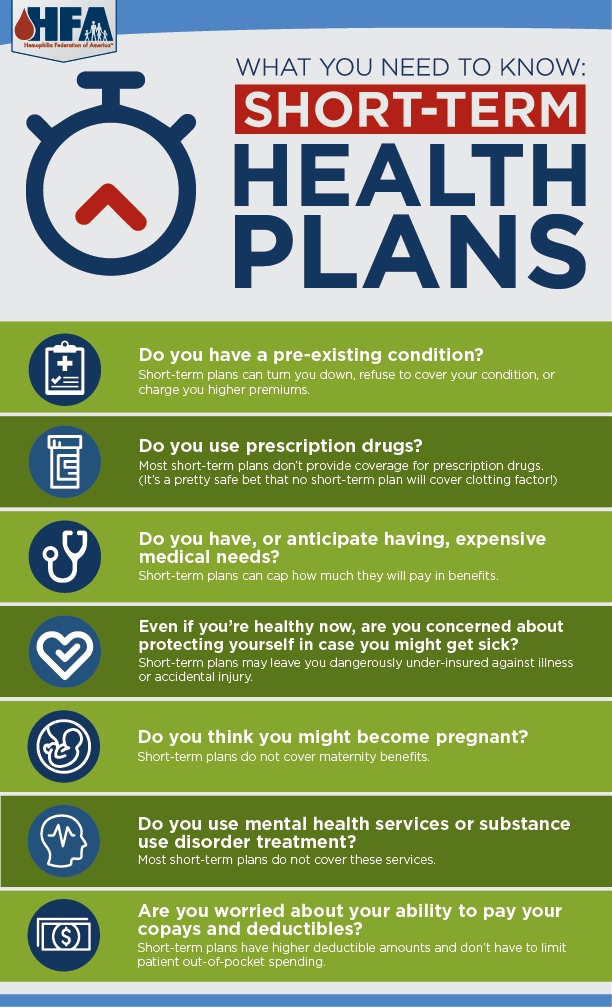

Short-term health insurance offers temporary coverage for specific needs. While it provides certain benefits, it also comes with several limitations that you should be aware of. Understanding these limitations can help you make an informed decision about whether short-term health insurance is right for you.

Coverage Gaps

Short-term health insurance plans often have significant coverage gaps. These plans do not cover essential health benefits like maternity care or mental health services. They also tend to have limited coverage for prescription drugs, which can be a major drawback for those who rely on regular medications.

Many short-term health insurance plans also do not cover pre-existing conditions. If you have a chronic illness, this could leave you without necessary care. Short-term plans might also exclude preventive services like annual check-ups and vaccinations.

Exclusions

Short-term health insurance plans come with numerous exclusions. These plans often exclude care for congenital conditions or injuries resulting from dangerous activities.

Below is a table highlighting common exclusions:

| Excluded Services | Examples |

|---|---|

| Pre-existing Conditions | Diabetes, Asthma |

| Maternity Care | Prenatal Visits, Childbirth |

| Mental Health Services | Therapy, Counseling |

| Preventive Services | Vaccinations, Annual Check-ups |

Understanding these exclusions is crucial. This way, you know what will not be covered. Always read the fine print of any short-term health insurance plan. This ensures you are fully aware of its limitations.

Who Should Consider

Short-term health insurance can be a great option for those facing temporary gaps in coverage. This type of insurance provides a safety net when traditional health plans are not an option. Below, we discuss who should consider short-term health insurance.

Ideal Candidates

Not everyone needs short-term health insurance. Here are the ideal candidates:

- Recent Graduates: Students who have just finished school and need coverage.

- Job Seekers: People between jobs or waiting for new employer benefits to start.

- Early Retirees: Retirees not yet eligible for Medicare.

- Seasonal Workers: Individuals with jobs that do not offer consistent coverage.

- Freelancers: Freelancers and gig workers who need temporary protection.

Situational Use

Short-term health insurance is useful in various situations. Consider it during these times:

- Waiting Periods: When there is a waiting period for other insurance to start.

- Coverage Gaps: When transitioning from one health plan to another.

- Traveling: If traveling and needing temporary coverage.

- Open Enrollment: Missed open enrollment? Short-term plans can bridge the gap.

| Ideal Candidate | Situation |

|---|---|

| Recent Graduates | Finished school, need coverage before getting a job. |

| Job Seekers | Between jobs, waiting for new benefits to start. |

| Early Retirees | Not yet eligible for Medicare, need interim coverage. |

| Seasonal Workers | Jobs with inconsistent coverage periods. |

| Freelancers | Need temporary protection while looking for long-term plans. |

Short-term health insurance is a flexible option. It fits various needs and situations, providing peace of mind when you need it most.

How To Choose A Plan

Choosing the right short-term health insurance plan can be challenging. This guide will help you make an informed decision. You will learn how to compare plans and what questions to ask.

Comparison Tips

To select the best plan, use these tips:

- Compare premiums: Check the monthly cost of each plan.

- Deductibles: Find out how much you pay before insurance kicks in.

- Coverage limits: Check what each plan covers and any limits.

- Network of doctors: Ensure your doctor is in the plan’s network.

- Customer reviews: Read what others say about the plan.

Important Questions

Before choosing a plan, ask these questions:

- What is the coverage period? – Know how long the plan lasts.

- Are there any exclusions? – Find out what is not covered.

- Can I renew the plan? – Check if you can extend the coverage.

- What are the co-pays? – Know what you pay for doctor visits.

- How easy is the claims process? – Ensure claims are easy to file.

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Monthly Premium | $100 | $120 | $90 |

| Deductible | $1,000 | $1,500 | $2,000 |

| Coverage Limit | $100,000 | $150,000 | $80,000 |

| Network | Wide | Moderate | Narrow |

| Customer Rating | 4.5 | 4.0 | 3.5 |

Frequently Asked Questions

What Is Short-term Health Insurance?

Short-term health insurance provides temporary coverage for unexpected medical expenses, typically lasting from one to twelve months.

Who Should Consider Short-term Health Insurance?

Individuals between jobs, recent graduates, or those awaiting other coverage should consider short-term health insurance.

How Does Short-term Health Insurance Work?

It offers limited coverage for medical expenses during a gap in regular health insurance, often with lower premiums.

What Are The Benefits Of Short-term Health Insurance?

Benefits include lower premiums, flexible terms, and quick approval, making it ideal for temporary coverage needs.

Does Short-term Health Insurance Cover Pre-existing Conditions?

No, short-term health insurance usually does not cover pre-existing conditions or comprehensive benefits like regular health plans.

Conclusion

Short-term health insurance offers flexible, temporary coverage for various situations. It’s ideal for those between jobs or awaiting long-term plans. This option provides peace of mind and financial protection. Remember to compare policies and understand the limitations. Choosing the right plan can make a significant difference in your healthcare journey.