Third-party car insurance is a type of insurance policy. It covers damages and injuries you cause to others while driving. It does not cover your own car or injuries.

Understanding Third-Party Car Insurance

Third-party car insurance is very important. It helps protect you if you cause an accident. It covers the costs of damages to other people’s property. It also covers medical expenses if someone gets hurt.

Why Is It Called Third-party Insurance?

In this insurance, there are three parties involved:

- First Party: The car owner or the person who buys the insurance.

- Second Party: The insurance company that provides the coverage.

- Third Party: Any other person who suffers damage or injury because of the first party.

So, it is called third-party insurance because it protects the third party.

Credit: www.coverfox.com

Why Do You Need Third-Party Car Insurance?

Third-party car insurance is required by law in many countries. Driving without it can lead to fines and penalties. Here are some reasons why you need it:

- Legal Requirement: It is mandatory in many places.

- Financial Protection: It helps you avoid paying large sums of money.

- Peace of Mind: You can drive knowing you are covered.

What Does Third-Party Car Insurance Cover?

Third-party car insurance covers several important areas:

| Coverage Area | Description |

|---|---|

| Property Damage | Covers the cost of repairing or replacing the third party’s property. |

| Medical Expenses | Covers the medical costs if the third party gets injured. |

| Legal Fees | Covers legal fees if the third party sues you. |

What is Not Covered by Third-Party Car Insurance?

While third-party car insurance offers important coverage, it does not cover everything. Here are some areas it does not cover:

- Damage to your own car.

- Injuries you suffer in an accident.

- Theft or loss of your car.

- Damage caused by natural disasters.

For these situations, you might need other types of insurance, like comprehensive car insurance.

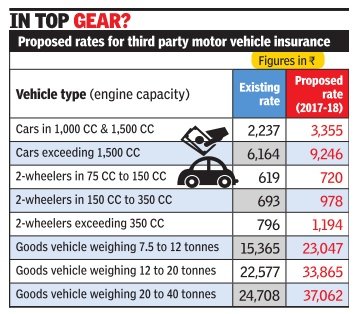

Credit: www.team-bhp.com

How Much Does Third-Party Car Insurance Cost?

The cost of third-party car insurance varies. It depends on several factors:

- Your car’s make and model.

- Your driving history.

- Your location.

Generally, third-party car insurance is cheaper than other types. But, it provides less coverage.

How to Buy Third-Party Car Insurance?

Buying third-party car insurance is easy. Follow these simple steps:

- Research different insurance providers.

- Compare their policies and prices.

- Choose the best policy for your needs.

- Fill out an application form.

- Pay the premium.

Once you complete these steps, you will receive your insurance policy. Keep it safe and always have a copy in your car.

Frequently Asked Questions

What Is Third-party Car Insurance?

Third-party car insurance covers damages to other people’s property or injuries in accidents you cause.

Why Is Third-party Car Insurance Required?

It’s legally required to cover potential damage or injury costs to others in case of an accident.

What Does Third-party Car Insurance Cover?

It covers damages to another vehicle, property, and medical expenses for injuries you cause to others.

How Is Third-party Car Insurance Different?

It doesn’t cover your own vehicle’s damage or personal medical expenses, only third-party liabilities.

Is Third-party Car Insurance Cheaper?

Generally, it’s more affordable than comprehensive policies because it offers limited coverage.

Conclusion

Third-party car insurance is a must-have for every driver. It protects you from financial loss. It also ensures you comply with the law. Make sure to choose the right policy for your needs. Drive safely and responsibly.